13 of Best Business Budgeting Software and Tools

As a business owner or finance professional, you know budgeting is essential to keeping your company financially safe and sound. But managing finances can be tricky and time-consuming.

However, without reliable budgeting software, it is impossible to get accurate data about where money should go and how much can be spent realistically in each area.

We will share 13 of the best business budgeting software programs available – helping you take complete control of your company’s financial future.

Table of Contents

Best Business Budgeting Software and Tools

QuickBooks Online

Businesses seeking to simplify their financial processes should consider using QuickBooks, an indispensable accounting tool. This budgeting software offer features that enable you to monitor expenses, generate personalized budgets, and track your expenses all year round.

Quickbooks has a user-friendly interface that makes it easy for businesses of all sizes to navigate and use. Its comprehensive and user-friendly design makes it an excellent investment for businesses that want to improve their financial management.

*QuickBooks Plus and Advanced plan only contain budgeting features. Simple Start and Essentials do not include budget features.

Benefits:

Budgeting and Forecasting – Create, track, and manage budgets and forecasts, helping businesses plan for the future, allocate resources effectively, and make informed financial decisions.

Seamless Integration with Other QuickBooks Services – Offers seamless integration with other QuickBooks services like Payroll, Payments, and Time tracking, ensuring a connected and efficient financial management ecosystem.

Automatic Bank Feeds and Reconciliation – Automatically imports transactions from your bank accounts, saving time on data entry and making the reconciliation process quicker and more accurate.

Automated Accounting Tasks – Enables automation of various routine tasks like sending invoices or receipts, saving time and reducing the likelihood of errors.

Price:

- QuickBooks Plus – $85 per month

- QuickBooks Advanced – $200 per month

Ideal Business:

All businesses from freelance, small, medium, large, and enterprise level

Xero

Xero is another ideal budgeting tool if you’re looking for an efficient solution to manage your company’s finances.

Particularly for small- to medium-sized businesses, Xero was created. You can manage your spending and revenue, create budgets, and expense management all in one place with the help of this cloud-based accounting system.

Payroll, point of sale, taxation, and expenditure management are just a few of the business tools that Xero can be integrated with.

Benefits:

Seamless Integration with Over 800 Business Apps – Provides a comprehensive, connected work environment, reducing the need for multiple software solutions and enhancing efficiency.

Budgeting and Forecasting Benefit: Enables businesses to create, monitor, and adjust budgets and forecasts, facilitating informed decisions and effective resource allocation.

Multi-Currency Capability – Handles transactions and reports in multiple currencies, a crucial feature for businesses operating internationally.

Automatic Bank Feeds and Reconciliation – Xero links directly to your bank account to automatically import and match transactions, saving time on data entry and improving the accuracy of financial data.

Price:

- Early Plan – $13 per month

- Growing Plan – $37 per month

- Established Plan – $70 per month

Ideal Business:

Small Business and Medium Business

FreshBooks

FreshBooks is a cloud-based accounting software specially designed for small businesses that need easy-to-use financial management software.

Ideal for businesses not looking for the complexities of traditional accounting software. Apart from budgeting, FreshBooks also offers customizable invoice branding, multi-currency support, and the ability to integrate with popular accounting tools such as QuickBooks.

The software’s analytics features provide users insight into their revenue and expense trends, allowing users to make informed financial decisions.

Benefits:

Double-Entry Accounting – Provides a robust accounting foundation, enabling users to maintain accurate financial records and gain deeper insights into their business performance.

Retainer Invoicing – Simplifies billing ongoing client relationships, allowing businesses to set up recurring invoices and track retainers, ensuring steady cash flow and better client management.

Project Budgets and Estimates – Allows businesses to set budgets for projects and create accurate estimates, enabling better cost management and preventing overspending.

Customizable Invoicing – Simplifies the invoicing process by allowing businesses to create professional, branded invoices, helping them get paid faster and maintain a professional image.

Price:

- Lite – $17 per month

- Plus – $30 per month

- Premium – $55 per month

- Custom – Contact for a personalized quote

Ideal Business:

Freelance and Small Business

Sage Business Cloud Accounting

Sage Business Cloud Accounting is an excellent solution for businesses seeking reliable budgeting software.

Unlike other budgeting software, Sage Business Cloud Accounting offers real-time insight into your finances, allowing you to make informed decisions while staying within budget.

Automating invoicing and payment processing saves time and reduces errors, while its customized reporting and forecasting tools enable you to track expenses and profits accurately.

Integrates seamlessly with other Sage products, this cloud-based accounting software offers a complete end-to-end solution for managing your business’s finances.

Benefits:

Real-Time Data Access – Offers up-to-date information on financial transactions and metrics, enabling businesses to make informed decisions quickly and accurately.

Compliance Management – Assists businesses in meeting their tax and accounting compliance requirements, ensuring they stay up-to-date with changing regulations and avoid penalties.

Financial Reporting – Provides comprehensive financial reports for better decision-making and business performance analysis.

Easy-To-Use Online Accounting – Streamlines financial management businesses, making it more efficient and less time-consuming.

Price:

- Sage Accounting Start – $10 per month

- Sage Accounting – $25 per month

Ideal Business:

Freelance and Small Business

PlanGuru

PlanGuru is a powerful and practical business budgeting tool designed to help business owners plan and make informed decisions backed by accurate financial data.

The software is user-friendly and integrates seamlessly with various accounting systems, making it easy to import financial data into the platform for analysis.

Also dynamic because it incorporates actual financial data with your forecasted or planned data to show you how your projections differ from reality.

Benefits:

PlanGuru Launch Service – Offers personalized onboarding and training to help users set up their financial plans, ensuring a smooth and efficient implementation process.

PlanGuru Analytics (web-based reporting platform) – Gives individuals access to their financial information and insights from any device with an internet connection by offering a web-based reporting tool that interacts easily with PlanGuru.

Integration with Accounting Software – Integrates with popular accounting software like QuickBooks and Xero, enabling users to import their financial data and simplify the budgeting process.

Advanced Budgeting and Forecasting Tools – Offers powerful tools, such as driver-based budgeting, to build complex budget models, helping businesses accurately predict financial outcomes and allocate resources effectively.

Price:

- Single Entity – $99 per month/ $75 billed annually

- Multi-Department Consolidations – $299 per month/ $225 billed annually

Ideal Business:

Freelancers, Small Business, Medium Business

Float

Float is a business cashflow budgeting software that assists small businesses and startups in managing their finances effectively. Users can access the finances at any time on any device using Float’s cloud-based software.

Users with backgrounds outside of finance can operate Float more easily thanks to its user-friendly interface and simple navigation. The intuitive drag-and-drop interfaces make it easy to create budgets and track expenses.

Data transfer is made simple by the software’s integration with other financial tools like Xero, QuickBooks, and FreeAgent. Businesses can maintain control over their finances, do away with guesswork, and stay on top of things with Float.

Benefits:

Daily Cash Flow Updates – Provides daily cash flow updates and cash flow reports to help users stay on top of their finances, allowing for quick adjustments and better cash flow management.

Cash Flow History Tracking – Tracks cash flow history, enabling users to analyze past performance, identify trends, and make more accurate future cash flow forecasts.

Cash Flow Confidence Scores – Offers cash flow confidence scores, helping users understand the reliability of their cash flow analysis and make better-informed financial decisions.

Budget Scenario Planning – Allows users to create multiple budget scenarios, assess potential outcomes, and make proactive financial decisions in response to changing circumstances.

Price:

- Essential – $49 per month/ $39 billed annually

- Premium – $99 per month/ $79 billed annually

- Enterprise – $199 per month/ $165 billed annually

Ideal Business:

Accounting Freelancers, Small Business, Medium Business

Workday Adaptive Planning

Workday Adaptive Planning is a business budgeting software that aims to streamline the budgeting process for any organization. It replaces the need for multiple spreadsheets, making the planning process an intuitive and collaborative experience.

Allows the identification of growth opportunities and the forecasting of financial results using real-time data insights. Businesses can manage cash flow forecasting, analyze financial performance, and model scenarios.

Workday Adaptive Planning is a potent financial planning tool that can save businesses time and aid in better financial decision-making.

Benefits:

Workday Integration – Offers seamless integration with Workday’s suite of enterprise applications, including Workday Financial Management and Workday Human Capital Management, creating a unified, end-to-end business management solution.

Collaborative Budgeting and Planning – Teams work together on budgeting and financial planning in real-time, improving collaboration, team efficiency, and decision-making.

Workday Adaptive Planning Office Connect – Provides an additional Excel add-in that allows users to create and update financial reports, budgets, and forecasts directly in Excel all while connecting to Workday Adaptive Planning.

Workday Adaptive Planning Process Tracker – Offers a built-in process tracker, helping users monitor the progress of budgeting and planning processes and ensuring timely completion.

Price:

Contact Workday for a custom quote tailored to your business

Ideal Business:

All businesses from small, medium, large, and enterprise level

Prophix

Any company looking to manage its finances effectively must have Prophix for Business budgeting software.

Some robust tools Prophix offers to users are multi-currency support, forecasting, and analysis to help create effective and efficient budgets.

Prophix’s reporting capabilities provide a clear and concise overview of an organization’s financial health, helping decision-makers make informed choices.

Benefits:

Collaborative Budgeting and Planning – Facilitates teamwork in budgeting and financial planning, enhancing collaboration, efficiency, and decision-making across the organization.

Data Integration and Automation – Integrates with various data sources and automates data collection, reducing manual data entry and ensuring accurate and up-to-date financial information.

Prophix Virtual Financial Analyst – Utilizes artificial intelligence to provide users with insights, automate routine tasks, and perform natural language queries, enhancing the user experience and efficiency.

Customizable Dashboards and Visualizations – Allows users to create custom financial dashboards and visualizations, providing a clear and tailored view of financial data and insights.

Price:

Contact Prophix for a custom quote tailored to your business

Ideal Business:

All businesses from small, medium, large, and enterprise level

Oracle Enterprise Performance Management (EPM)

Oracle EPM is an enterprise planning software solution designed to help businesses manage their budgeting process more effectively.

It offers a variety of features and tools, including consolidation and reporting, budget planning and forecasting, strategic planning, and budget planning.

This software is helpful for larger businesses that manage multiple budgets and financial plans across departments or business units.

Overall, Oracle EPM is an ideal solution for large businesses looking to streamline their budgeting process and better understand their financial performance.

Benefits:

Flexible Deployment Options – Businesses can deploy Oracle EPM on-premises, in the cloud network, or as a hybrid, allowing organizations to select the best option based on their requirements and infrastructure.

Advanced Data Management and Integration – Provides strong data management and integration capabilities, automating data collection, validation, and transformation, minimizing manual effort, and guaranteeing accurate and current financial information.

Artificial Intelligence (AI) and Machine Learning (ML) Capabilities – Uses AI and ML to automate repetitive tasks in place of manual work, improve forecasting precision using cash flow data, and offer insightful data for better decision-making.

Configurable, Role-Based Security – Allows for granular control over user access and permissions based on roles, ensuring the right individuals can contribute and review financial information as needed.

Price:

Contact Oracle for a custom quote tailored to your business

Ideal Business:

All businesses from small, medium, large, and enterprise level

Centage Planning Maestro

Are you looking to simplify your business budgeting process? Look no further than Centage Planning Maestro! This software offers robust financial planning and analysis tools to make accurate budgets and forecasts.

Businesses can enhance the accuracy of their budgeting process, minimize the risk of errors, and make informed decisions based on data-driven insights with Centage Planning Maestro.

With Planning Maestro, businesses can reach their financial goals by accessing all the necessary tools for budgeting, planning, analyzing, and forecasting their finances.

Benefits:

Driver-Based Modeling – Create driver-based financial models, connecting key business drivers to outcomes and improving the accuracy and relevance of forecasts and plans.

Automated Data Integration – Automating data integration capabilities minimize manual data entry, ensuring the accuracy of financial information and streamlining the budgeting process with up-to-date data.

Pre-Built Templates and Structures – The platform offers pre-made budget templates and structures to simplify the budgeting process for users to set up quick and efficient implementation.

Role-Based Access Control and Security – Implements measures to ensure that only authorized users can access and modify financial data.

Price:

Contact Centage for a custom quote tailored to your business

Ideal Business:

Small Business and Medium Business

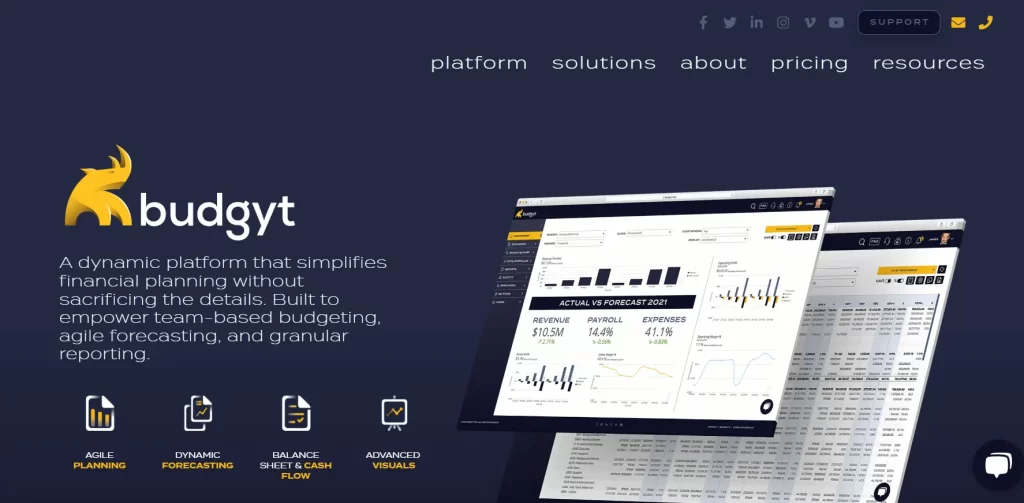

Budgyt

Managing your business finances can be overwhelming, but with Budgyt, budgeting has never been easier.

This innovative software allows you to streamline your budgeting process, providing a clear view of your estimated expenses and revenue all at a glance.

With Budgyt, you can easily create budgets, track expenses, and analyze spending data, empowering you to make informed financial decisions for your business.

Because the software can be accessed from anywhere, it is ideal for businesses with remote teams or multiple locations.

Benefits:

Formula-Free Budgeting – Allows users to create budgets without relying on complex spreadsheet formulas, making the budgeting process more accessible and user-friendly.

Department-Level Budgeting – Facilitates the creation of budgets at the departmental level, providing granular control over the allocation of resources and enabling better alignment with overall business goals.

Customizable User Roles and Permissions – Offers customizable user roles and permissions, ensuring that only authorized users can access and modify financial data and promoting accountability and security.

Budget vs. Actual Tracking – Provides real-time tracking of budget vs. actual performance, helping businesses monitor their financial progress and make adjustments as needed.

Price:

Contact Budgyt for a custom quote tailored to your business

Ideal Business:

All businesses from small, medium, large, and enterprise level

Scoro

Scoro is a comprehensive business management software that covers everything from project tracking to invoicing to team collaboration, including budgeting.

With Scoro’s budgeting software, you can accurately monitor your income and expenses, track key financial metrics, billing and expense tracking, and forecast future performance. Integrates easily with your accounting system to keep your data up to date.

Businesses can quickly analyze their financial data with powerful analytical tools. Identify trends and take necessary action to prevent or reduce financial risks.

Scoro is a great choice for businesses that want to simplify the project and financial management to improve their business operations.

Benefits:

All-In-One Business Management Platform – Combines essential business tools from budgeting, project management, and CRM all into one solution. Reduces the need for multiple software solutions, resulting in increased efficiency for your business.

Customizable Dashboards and Reports – Allows users to create customizable dashboards and reports, enabling them to visualize and analyze financial data that best suits their needs and preferences.

Integrations with Third-Party Applications – Integrates with other applications, including accounting software, email clients, and calendar apps. Creates a highly connected and efficient work environment with apps already used.

Resource Allocation and Planning – Facilitates resource allocation and planning by providing tools to schedule tasks, assign team members, and monitor workloads, ensuring efficient use of resources and alignment with budget goals.

Price:

- Essential – $28 per month/ $26 billed annually

- Standard – $42 per month/ $37 billed annually

- Pro – $72 per month/ $63 billed annually

- Ultimate – Contact Scoro for custom quote

Ideal Business:

Small Business and Medium Business

Vena Solutions

Vena Solutions is versatile and efficient budget management software designed to simplify the process of budgeting and analysis.

Many businesses regardless of size, favor this for its capability to automate manual processes that are repetitive and time-consuming. Its robust and flexible features allow users to create custom reports and dashboards that meet their needs.

Its intuitive interface and user-friendly design make it easy for financial professionals and non-financial experts, while its security features protect confidential information.

Consider Vena Solutions if you need a reliable and affordable budgeting software solution.

Benefits:

Excel-Based Interface – Leverages Microsoft Excel interface, allowing users to take advantage of existing skills and minimizing the learning curve for new users.

Integration with Existing Systems – Integrates with various ERP, HR, CRM, and other business systems, providing a connected and efficient work environment.

Centralized Data Repository – Central data stores all financial and operational data, ensuring data consistency, accuracy, and easy access for analysis and reporting.

Role-Based Access and Permissions – Ensures only authorized users can access and modify financial data with role-based access controls and permissions, promoting accountability and security.

Price:

Contact Vena Solutions for a custom quote tailored to your business

Ideal Business:

All businesses from small, medium, large, and enterprise level

FAQs

What is Business Budgeting Software?

Business budgeting software is a tool that helps companies manage their finances efficiently. Enables businesses to create, analyze, and adjust budgets for various departments and projects.

The software is a digital system for businesses to create and track budgets, forecast their financial future, and make informed decisions based on this information.

Investing in business budgeting software helps companies visualize their financial position, streamline their processes, and reduce the risk of costly errors, making it an invaluable asset for success.

Does QuickBooks Have a Budgeting App?

Yes, QuickBooks does have a mobile app that allows users to manage many of their accounting tasks on the go.

However, the budgeting feature is not available on the mobile app. QuickBooks mobile app supports tracking expenses, creating and sending invoices, capturing receipts, and viewing financial reports.

Closing Thoughts

There are a lot of different options for budgeting software available. Choosing the right budgeting tool can revolutionize your business and gain more control over finances.

From on-premise models for established businesses to cloud-based solutions for startups, our list has something for every type of business.

We provided a thorough list of the best business budgeting tools available, each with its own benefits and features.

Take some time to review our list of the best budgeting software to ensure you select the perfect option that meets your current needs and suitable option for your business.