5 Best Credit Card Management Apps to Stay Organize and Pay on Time

You have many credit cards and debit cards now, which makes it harder to manage all of them and know how to optimize them better. Managing your credit cards has always been challenging. Everything is moving towards mobile applications, and finance management is no exception.

While personal finance trackers have been in the market for some time now, credit card management mobile apps have recently seen a significant surge in use.

We will explore the top credit card management apps on the market and help you select one that best meets your financial requirements.

Table of Contents

Best Credit Card Management Apps

CRED

A credit card management platform and credit card payment app that primarily focuses on rewarding users for their financial responsibility. By paying their credit card bills on time through CRED, users earn CRED coins to redeem for various exclusive rewards.

Receive exclusive rewards, experiences, loyalty programs and cashback for bill payment users – making it more than another app. As with any tech company, their commitment to security ensures users’ data remains protected while their user-friendly interface makes the bill payment process seamless and hassle-free.

Benefits

- Earn reward points in the form of CRED coins for every credit card bill payment. Allows users to earn and redeem points for exclusive rewards. Encouraging timely credit card payments for rewards. Who doesn’t want that?

- Get access to exclusive offers and experiences from top brands. You will earn rewards from well-known brands, not random unknown brands.

- Real-time credit score tracking to keep you always aware of your financial health. You’ll always pay on time for the rewards.

CRED Pros

CRED Cons

CardPointers

Open to making credit card rewards accessible and understandable for everyone. Many users were leaving money on the table by not optimizing their card usage, so the company developed an app that would provide real-time, data-driven recommendations.

Staying updated with the latest offers and maximizing returns is challenging with so much going on. CardPointers addresses this by giving real-time recommendations on which card to use for specific transactions and taking advantage of the best rewards or usage. Whether travel, dining, or shopping, CardPointers ensures users get the best rewards or cashback.

Benefits

- Offers real-time recommendations on which card to use, ensuring users always get the best rewards or cashback.

- Consolidates all card offers in one place. Tracks offers and bonuses across cards.

- Insights into potential rewards and cashback that are personalized for you.

CardPointers Pros

CardPointers Cons

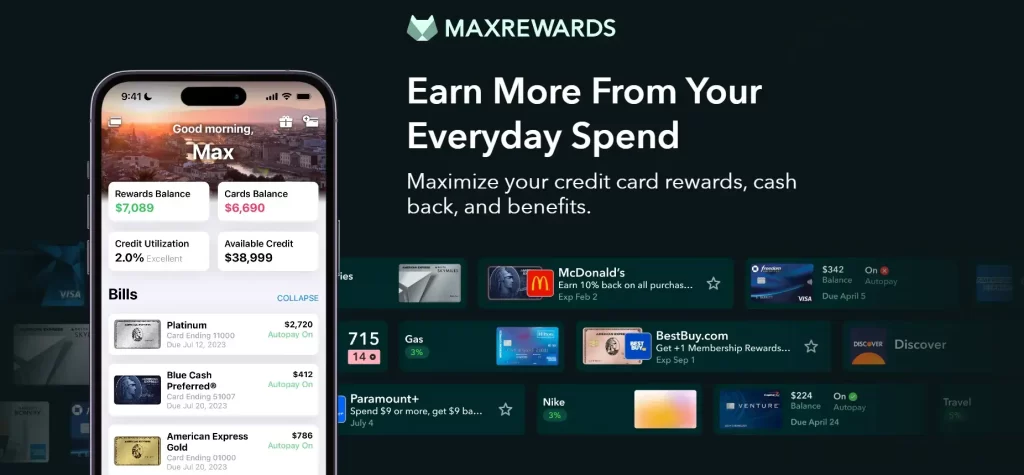

MaxRewards

Only a few credit card users are maximizing their credit card benefits now, and now, simplifying credit card rewards, bonuses, and benefits is more effortless. MaxRewards leverages technology to provide a solution and educates them to get the most out of their cards.

Answering the question: “Which credit card should I use for this purchase?” The app will analyze the rewards and benefits of each credit card offers and give you the best-optimized suggestions to ensure maximum rewards. Beyond just recommendations, the app offers a bird’s eye view of all rewards across different cards, and its automated bonus activation feature ensures that users take advantage of all potential rewards.

Benefits

- Automated activation of card bonuses, ensuring users never miss out on any rewards.

- Offers personalized advice tailored to individual spending habits to maximize rewards.

- Provides a bird’s eye view of all rewards, helping users make informed spending decisions.

MaxRewards Pros

MaxRewards Cons

Prism Pay Bills

It was created to simplify the complex world of billing management. Many individuals face difficulty handling multiple bills simultaneously; why not make an all-in-one solution that would eliminate numerous apps or manual tracking processes?

Prism stands out as an innovative bill management solution that integrates easily with an extensive number of billers worldwide – even credit card companies! All your bills within one app for easy account management and avoidance of missed payments.

Benefits

- Extensive integration with a vast array of billers, making it a one-stop solution for all bill payments. Include 11,000+ billers integrated, more than any apps.

- Consolidates all bills in one place and no longer has to switch to other vendors to view bills, ensuring no missed payments.

- Direct payment options and automated bill payment features reduce manual tracking for upcoming and paid bills.

- Calendar view for planning and scheduling payments for a better overview.

Prism Pros

Prism Cons

Tally

Tally provides an innovative credit card management solution designed specifically to assist those struggling with high-interest rates and late fees from credit cards, offering relief. They offer a line of credit at competitive lower interest rates than their competitors.

Tally can intervene when faced with an impending due date and insufficient funds, covering the payment at a rate typically lower than the bank’s interest. Besides just being a payment tool, Tally is a financial advisor, giving you the best strategies to reduce your debt efficiently and boost your credit scores. No more paying high amounts of money to your financial advisor.

Benefits

- Provides its line of credit at a lower interest rate, acting as a safety net for users during payment due dates. Tally will pay off your current debt, and you will pay back Tally with a lower interest rate than what you had.

- Have all credit card debts in one platform for the best overview. Reduces the chances of missed payments and having to incur high interest.

- Offers insights and recommendations to manage your debt effectively. You’ll pay off your debts faster based on your financial situation.

Tally Pros

Tally Cons

What Are Credit Card Management Apps?

They are finance management software tools designed to assist users in overseeing credit card usage and payments more efficiently. With the growing trend of using mobile applications for finance management, these apps have gained immense popularity amongst the masses.

Credit Card Management Apps assist users in effectively overseeing finances by offering various features, such as tracking expenses and setting budget alerts, making timely payments, recording reward points earned on credit card usage, and reminding users when the time has come to redeem them.

Personal Finance Vs. Credit Card Management Apps

One significant difference between Personal Finance and Credit Card Management Apps is their primary focus. Personal Finance apps provide an overview of all finances, including savings, investments, and debts, whereas Credit Card Management Apps solely focus on credit card transactions.

Why Do You Need A Credit Card Management App?

Are you tired of keeping track of multiple credit cards with varying limits, due dates, and reward systems? Are you struggling to keep your finances in check and avoid compulsive buying? Credit card management apps are the solution you need!

Use credit card management apps to organize and monitor your spending and gain better financial control. These apps help organize all your credit cards conveniently, notify you about upcoming payments, and suggest ways to maximize benefits through spending optimization.

Credit card management apps solve many problems that otherwise become difficult to handle. One of the most significant benefits is reducing having to calculate expenditures manually. They automatically do it for your payments, so you don’t have to log them manually.

Another winning benefit of using credit card management apps is their ability to identify fraudulent transactions. With artificial intelligence, these apps can detect any abnormal or potentially fraudulent activity as soon as it occurs. Keeping your bank accounts secure and avoid losing money from scammers.

Moreover, credit card management apps streamline your finances by offering visual representations of your expenditures, enabling you to understand your spending patterns and make necessary changes.

How To Choose The Best Credit Card Management App?

Choosing the right credit card management app can be overwhelming, considering the variety of options available in the market. But don’t worry, we have got your back! Here are a few factors you can consider when narrowing down your choices:

- The credit card management app should provide comprehensive features that cater to your financial management requirements. It should allow you to track your expenses, set budgets, view account balances, and access bill payment reminders.

- While choosing a credit card management app, ensure your personal information and financial data are safe and secure. Look for apps incorporating encryption technology security layers and stringent privacy policies. Also, check for user reviews and ratings to gauge the app’s reliability and security features.

- Ensure that your credit card management app provides user-friendly and intuitive navigation.

Clumsy and complex apps can turn your financial management into a tiresome and stressful experience. Make sure the app you use provides a seamless user experience that saves time and effort.

FAQs

Closing Thoughts

These top credit card management apps can help simplify your finances and help keep you on track with your spending goals. They offer an integrated view of personal finances and credit card balances to assess your financial standing holistically.